markit short interest

Highest Short Interest Float. Peter Lynch SL Traded Below Book.

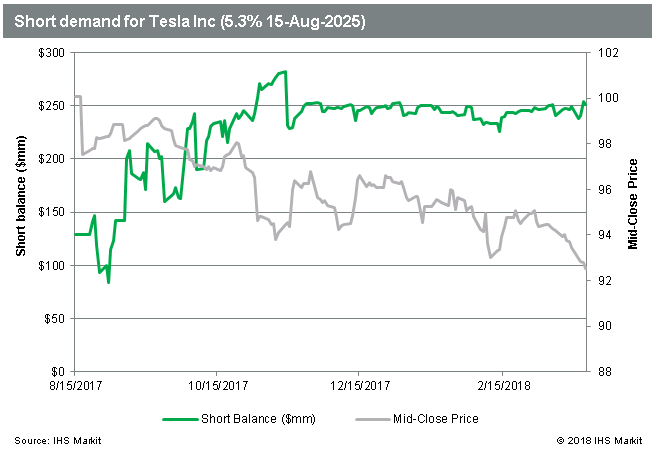

Who Would Short Tesla Ihs Markit

IHS Markit posted the biggest increase in short interest relative to shares outstanding among SNL-covered financial services companies between June 30 and July 15.

. In depth view into IHS Markit Short Interest explanation calculation historical data and more. However Active Utilization differs from Utilization in that stocks not actively lent are filtered out. As of February 15th there was short interest totaling 21450000 shares an increase of 567 from the previous total of 13690000 shares.

We noticed youve identified yourself as a student. Through existing partnerships with academic institutions around. We are working on a corporate rebrand for our product names.

Ranking by the percentage of shares on loan yields a similar result for January with most-borrowed outperforming by 236 MTD. At the same time highly utilized names are at risk of short squeeze. Holistic transparency into short interest dynamics to support investment decisions asset allocation and risk management.

A well-known use for US equity finance data is the estimation of the Short Interest published by US exchanges in between the bi-monthly publications of. IHS Markit presently has an average rating of Buy and a consensus price target of 7660. James Montier Short Screen.

The business services provider reported 065 earnings per share for the quarter topping the consensus estimate of 061 by 004. Versatile and scalable software platforms and services allowing institutions to manage information. Estimating short interest in real-time.

As of December 13th there was short interest totalling 12. IHS Markit saw a increase in short interest in the month of February. In depth view into MEXINFO Short Interest explanation calculation historical data and more.

IHS Markit API Introduction What are Web APIs. October 9 2012 Shining the Light on Short Interest 4 Factor Introduction Active Utilization and Utilization factors are similar in intuition as they both classify supply and demand shifts in the equity lending market. Short Interest Global securities financing data providing market leading analytics on short seller demand supply and borrow costs for both Equities and Fixed Income.

We can also seamlessly integrate with existing e-procurement platforms including Coupa Ariba Oracle EBS SAP SRM Ivalua and more. Manage a group of companies with just one login assign users with limits and rights or decide safe categories for purchasing. Peter Lynch Growth w Lower Valuation.

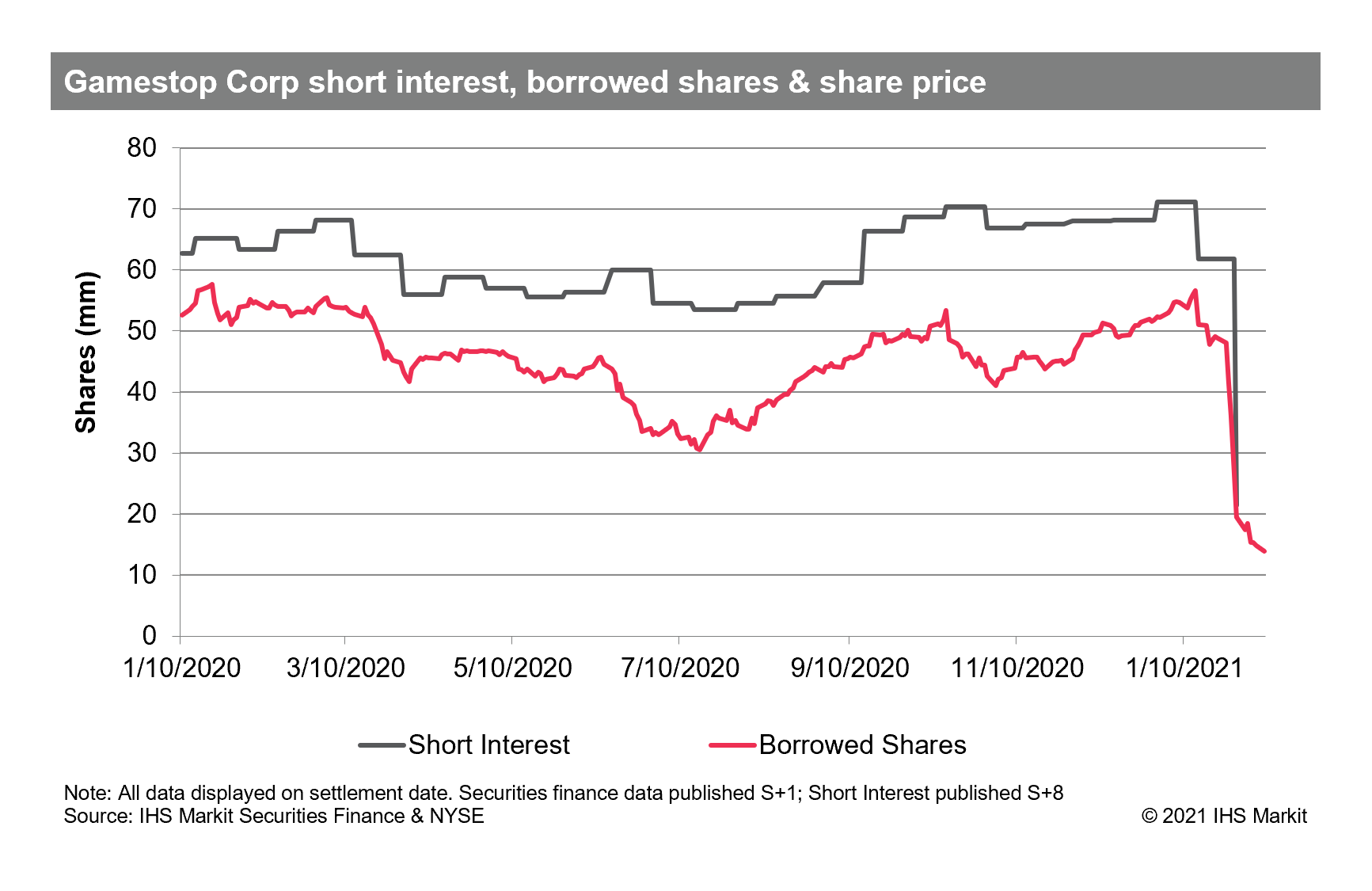

OWNERS Retail Ownership Funds Flow - World Most Popular Funds Activist Investors. Data from s3 partners another market intelligence firm showed a similar pattern with gamestops short sales having fallen to about 50 of its total stock available to trade down from a high of. A way to access your data in real time A way to automatically Add Update and Retrieve data from your database A way to do it intuitively thoroughly and securely Web API API Standards We use industry standards for programming Web APIs Modeled after leading API design Apigee Web API.

Short Interest in IHS Markit Ltd NYSEINFO Grows By 505. The nearest competition for worst month for short factors consists of April 2009 when the most shorted outperformed 15 and April 2020 most shorted outperformed by 21 per the IHS Markit Research Signals database. Markit is built with large and complex organisations and purchasing teams in focus.

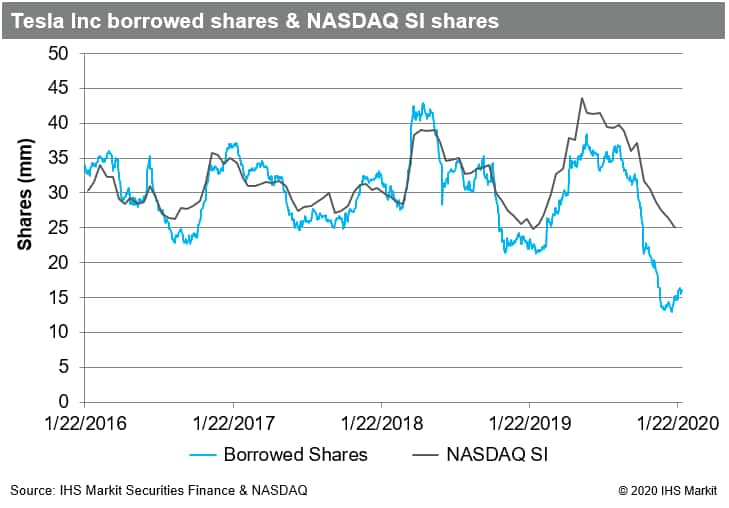

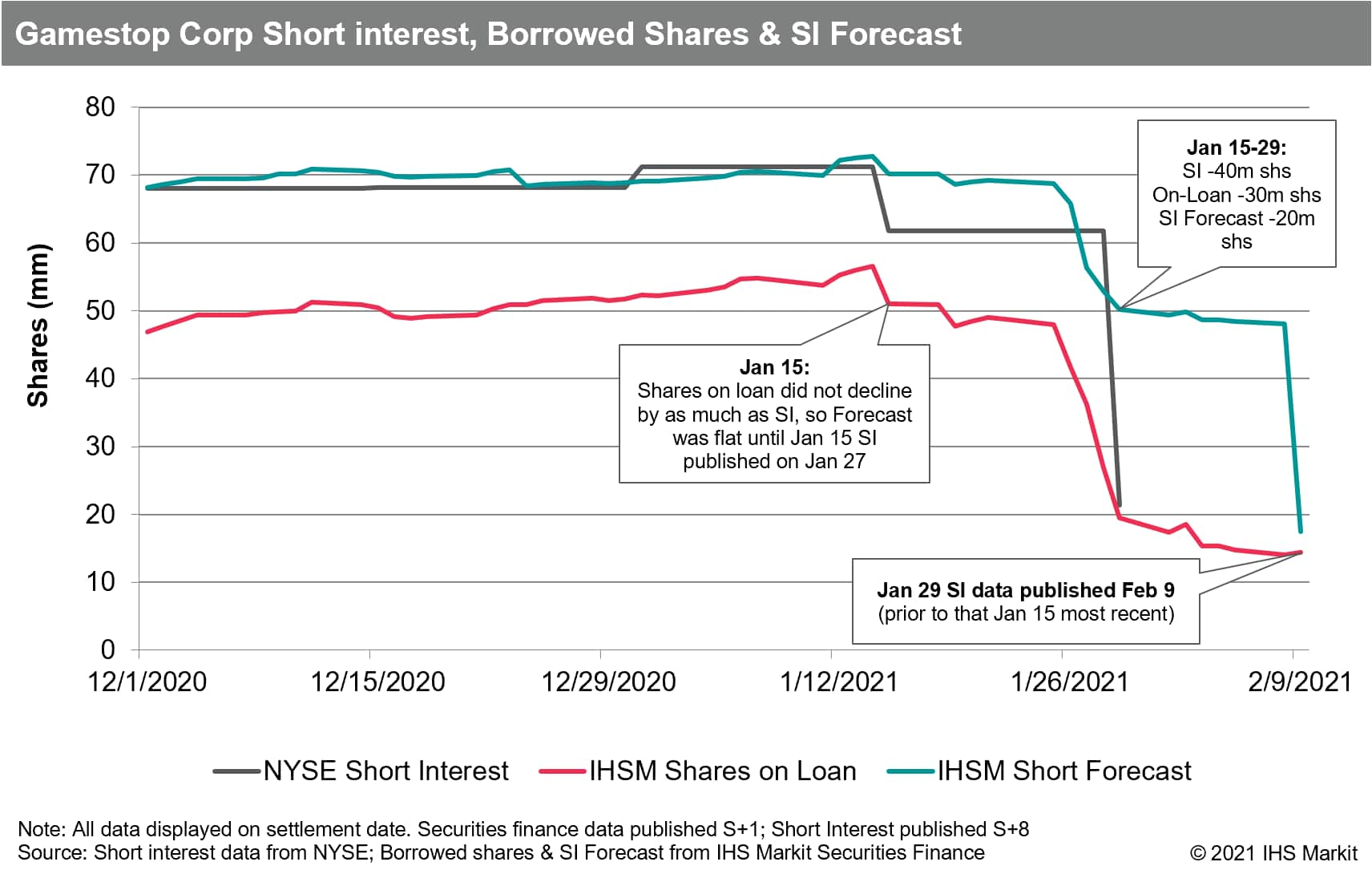

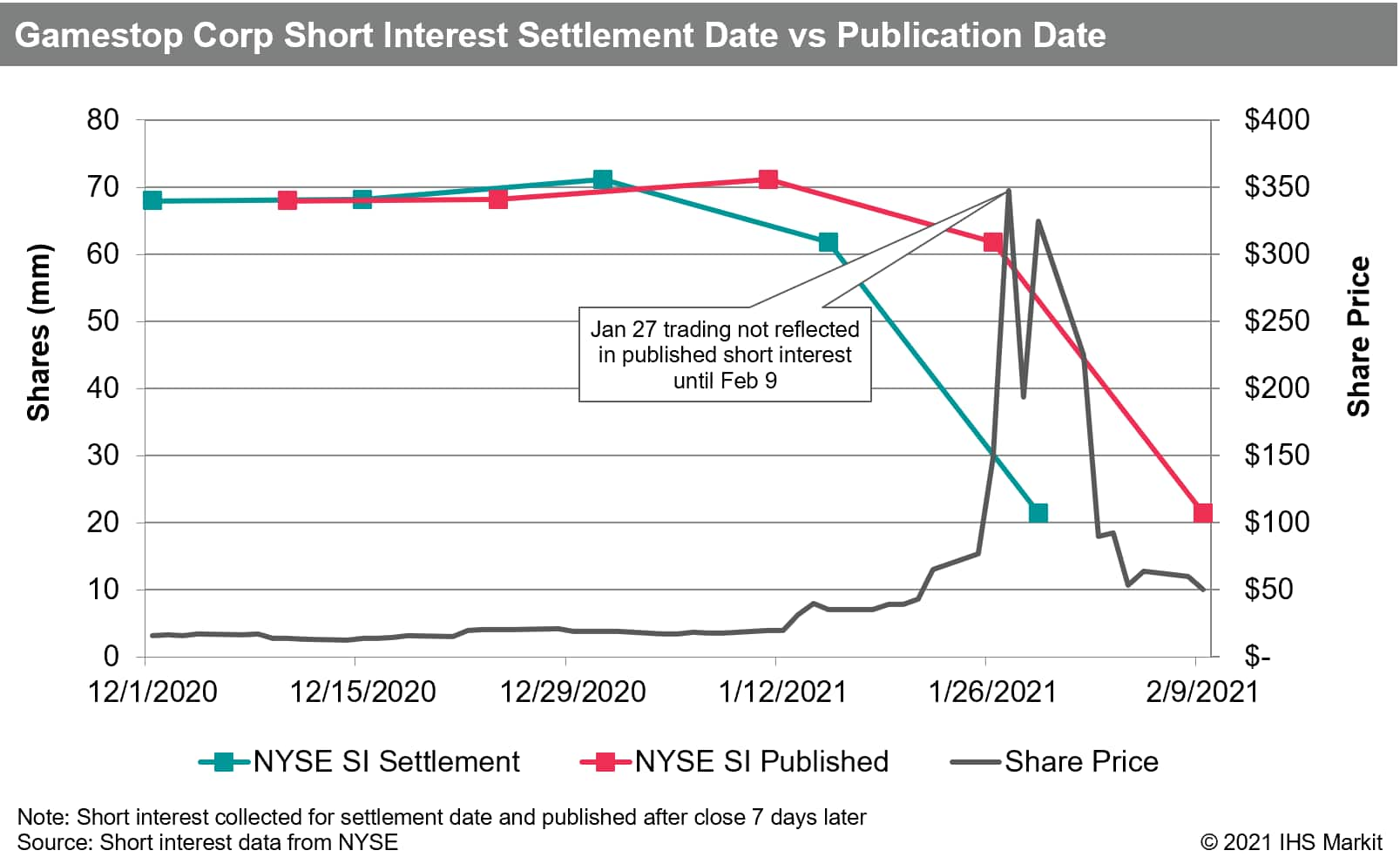

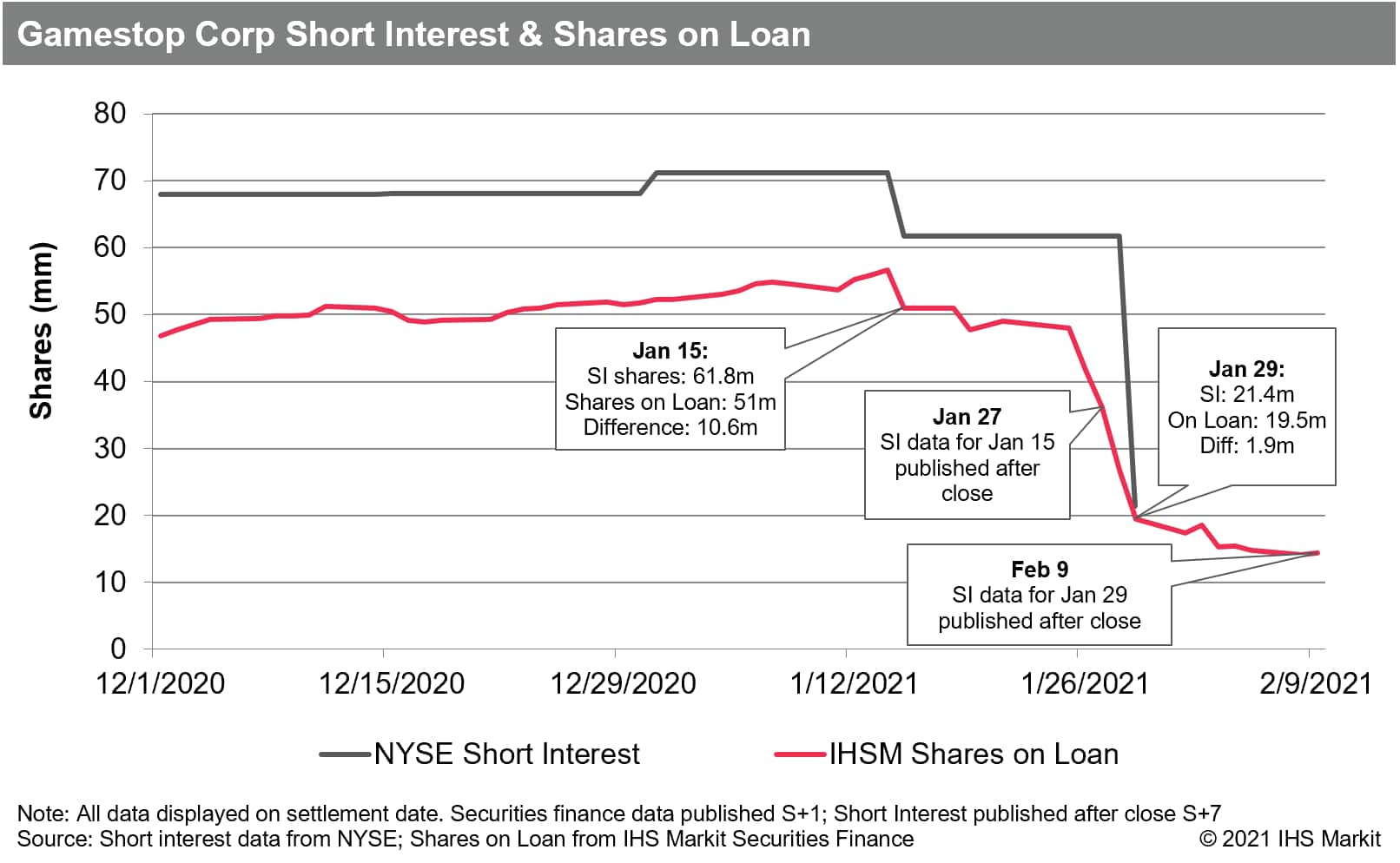

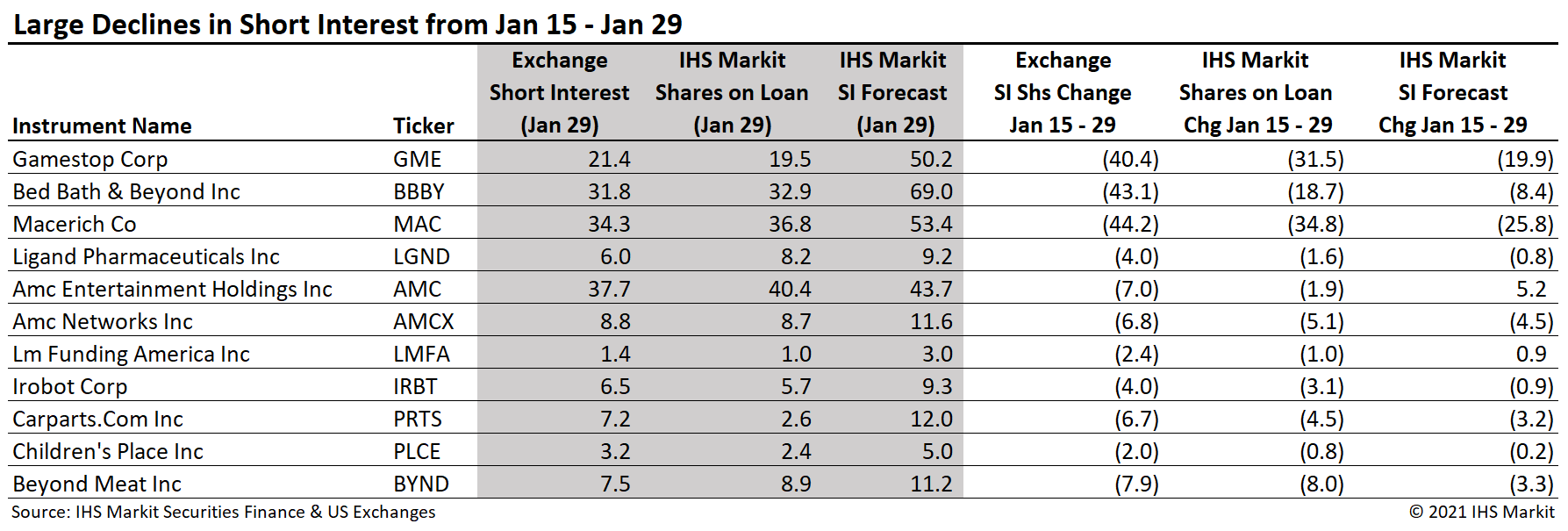

The IHS Markit Short Interest dataset includes stock loan availability and volume short interest and metrics reflecting the supply and demand in the securities lending market along with the flow of funds driving market prices. INFO Short Interest as of today December 30 2021 is. Short squeeze by the numbers 12 February 2021 Sam Pierson.

Use the login box to the right to login to the following Markit products. Privacy and Cookie Policy Terms Of Use Disclaimer Contact Us 2022 IHS Markit. Processing services for OTC derivatives FX and loans streamlining workflow and improving connectivity.

IHS Markit Short Interest as of today January 11 2022 is. This is done to take into. Short interest in the video-game retailer plummeted to 39 of free-floating shares from 114 in mid-january according to ihs markit ltd.

The short interest ratio also known as the days to cover ratio is calculated by dividing the number of shares of a stock sold short divided by its average trading volume. Dec 28 2019 215 AM UTC The Stock Observer IHS Markit Ltd NYSEINFO. Short Interest in IHS Markit Ltd NYSEINFO Grows By 505.

INFO last issued its quarterly earnings data on Tuesday January 14th. Product names might differ. Names in high demand a proxy for highly shorted and those with a high cost to borrow tend to underperform the market.

Changes in short volume can be used to identify positive and negative investor sentiment. The scoring model uses a combination of short interest float short borrow fee rates and other metrics. Markits Securities Finance data provides a timely detailed look at the short interest market.

The number ranges from 0 to 100 with higher numbers indicating a higher risk of a short squeeze relative to its peers and 50 being the average. Product names might differ after login. We are working on a corporate rebrand for our product names.

Use the login box to the right to login to the following Markit products. Interpretation key for short interest equity finance. Singaporean shares saw a surge in short interest in the midst of the volatility seen in the first quarter but the STI indexs recent calm has seen appetite to short shrink.

GameStop illustrates data and methods. Short interest-related data published daily from prime brokers hedge funds and securities custodians. A short interest ratio ranging between 1 and 4 generally indicates strong positive sentiment about a stock and a lack of short sellers.

United States Canada UK Hong Kong Japan Australia New Zealand. Thank you for your interest in SP Global Market Intelligence. Peter Lynch Warren Buffett.

Indices pricing and reference data across asset classes enabling our customers to price instruments value portfolios and manage risk. INFO - Short Interest - IHS MARKIT LTD Stock - Short Squeeze Short Sale Volume Borrow Rates Fails-To-Deliver. A number of research firms have recently weighed in on INFO.

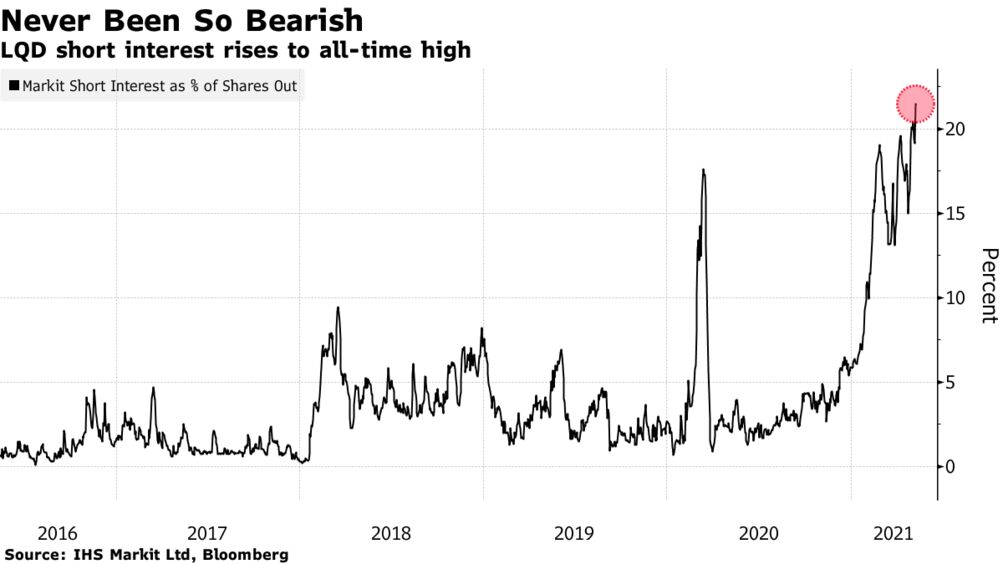

Bets Against The Biggest Credit Etf Are At Highest On Record Bloomberg

Corporate Bond Short Interest Factor Ihs Markit

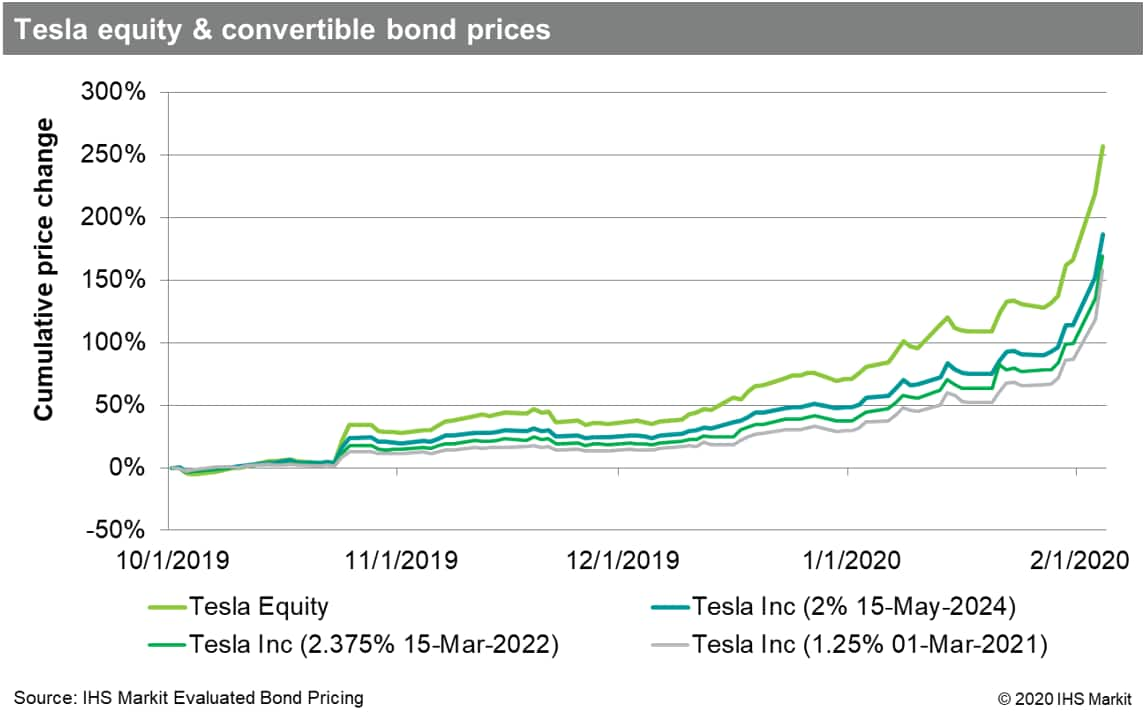

Who Would Short Tesla Ihs Markit

Short Squeeze By The Numbers Ihs Markit

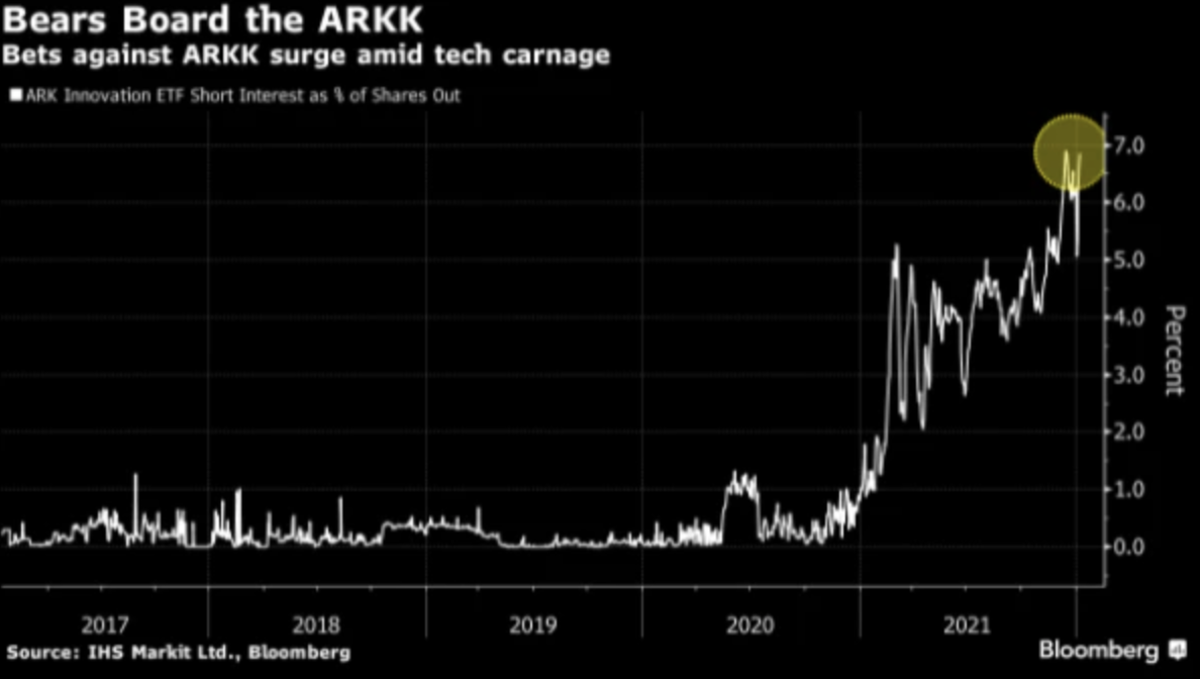

Arkk Will We See A Short Squeeze A La Gme Amc Cathies Ark

Sam Pierson On Twitter Jan 29th Short Interest Data Just Published Showing That Gme Short Interest Was Down To 21 4m Shares For Jan 29th Settlement Https T Co Gddphrx6ov Twitter

Desire To Short Cathie Wood S Arkk Is Dropping Almost As Fast As The Fund

Bets Against The Biggest Credit Etf Are At Highest On Record Bloomberg

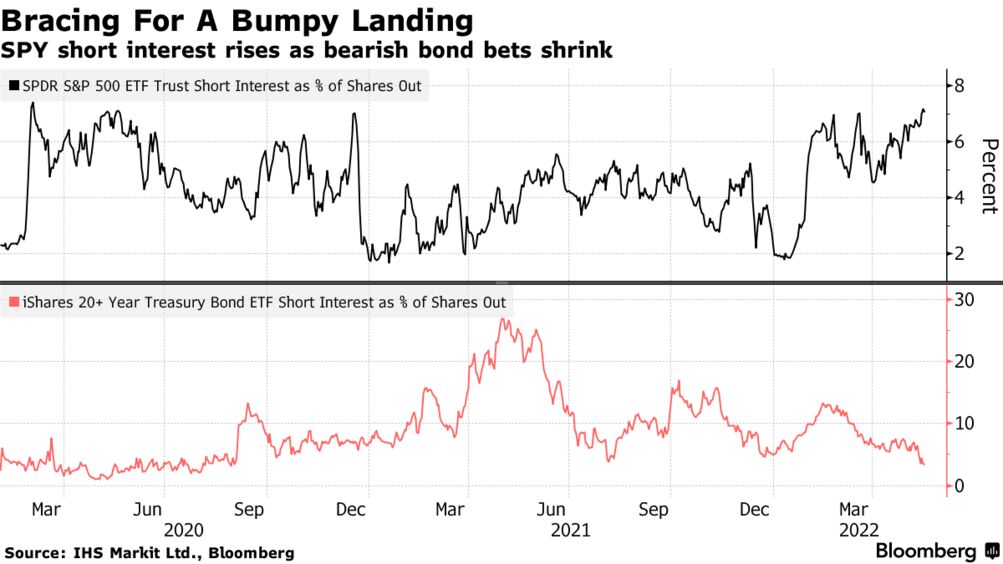

Short Sellers Line Up Against Stocks As Bearish Bond Bets Vanish Bloomberg

Short Burn Spares Few Ihs Markit

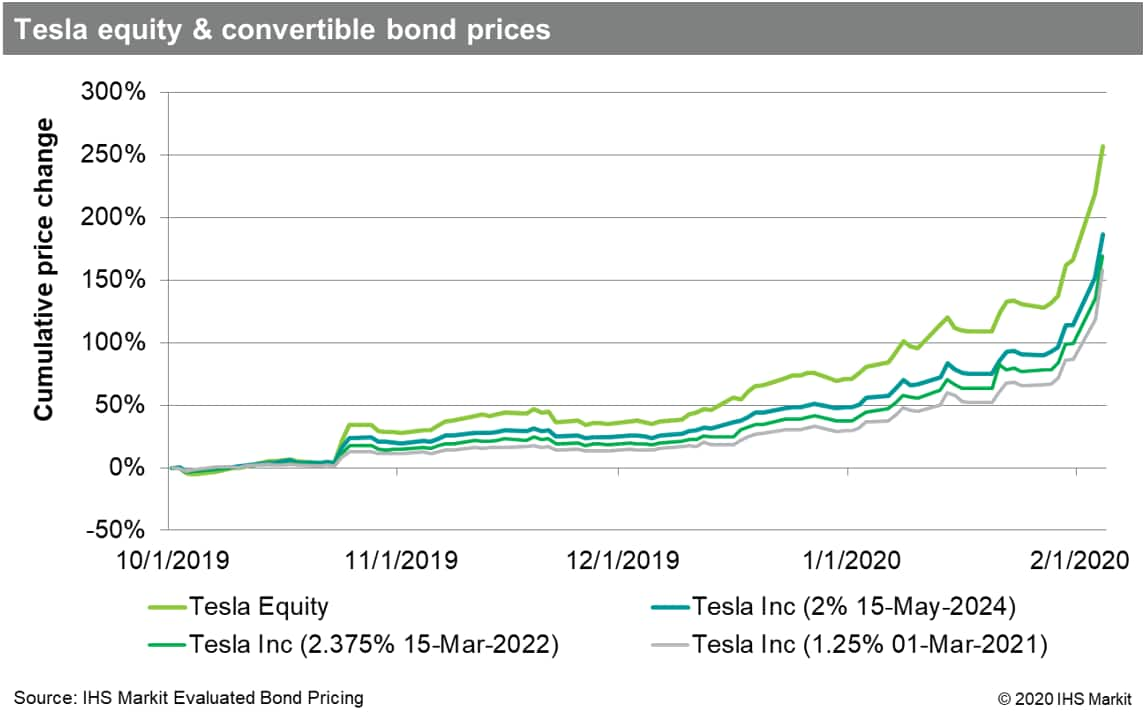

Tesla Is Heavily Shorted Across The Capital Structure Ihs Markit

Spdr S P 500 Etf Spy Short Interest Isabelnet

Short Squeeze By The Numbers Ihs Markit

Corporate Bond Short Interest Factor Ihs Markit

Short Squeeze By The Numbers Ihs Markit

Gary Black On Twitter Ihs Markit Another Credible Market Intelligence Firm Estimates Gme Short Interest Has Collapsed To 39 From 114 Supporting S3 S Estimates This Implies Odds Of A Further Gme Short

Margin Debt Is Declining What This Means For The Bulls Seeking Alpha

Short Squeeze By The Numbers Ihs Markit

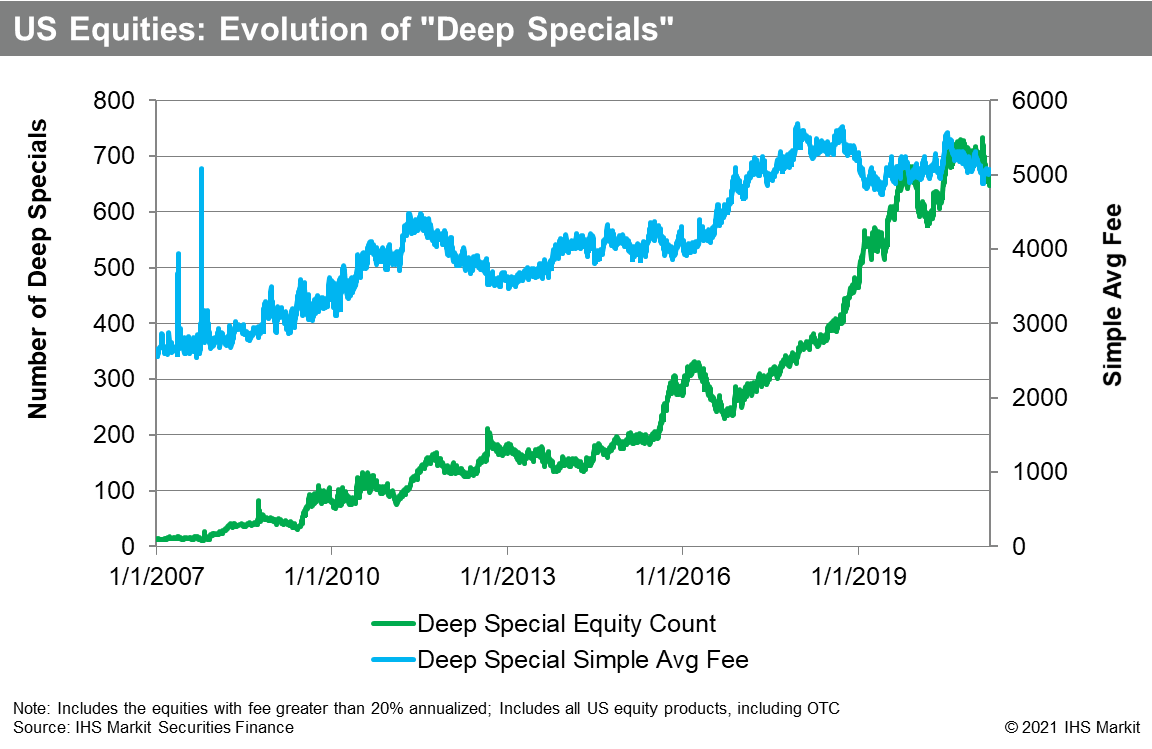

Us Equity Specials Note Ihs Markit

0 Response to "markit short interest"

Post a Comment